If you are looking to secure a loan against a book, a loan against a first edition, or finance using rare and collectible books, our expert-led service provides a trusted, discreet and highly specialised route to unlocking capital from high-value literary assets. Edinburgh Asset Finance (EAF) is one of the UK’s leading premium pawnbroking specialists, offering immediate funding against rare books, important first editions, fine bindings, and historically significant volumes.

Whether you own a single landmark first edition or a curated private library, we provide fast valuations, direct decision-making, and a confidential, premium experience designed for collectors, academics, dealers, and private individuals seeking efficient short-term finance without selling or consigning to auction.

What Types of Rare Books Can You Borrow Against?

We are able to lend against many categories of rare and collectible books, including but not limited to:

High-Value First Editions

We regularly lend against premium first editions, particularly those with confirmed edition points or original wrappers. Examples may include:

- 20th-century modern first editions (e.g., Tolkien, Fleming, Orwell, Potter)

- Victorian first editions in original cloth

- Important earlier works in contemporary bindings

Fine Bindings & Limited Editions

Books bound by notable binders, luxury limited editions, signed deluxe editions and presentation copies are especially suitable for secured lending.

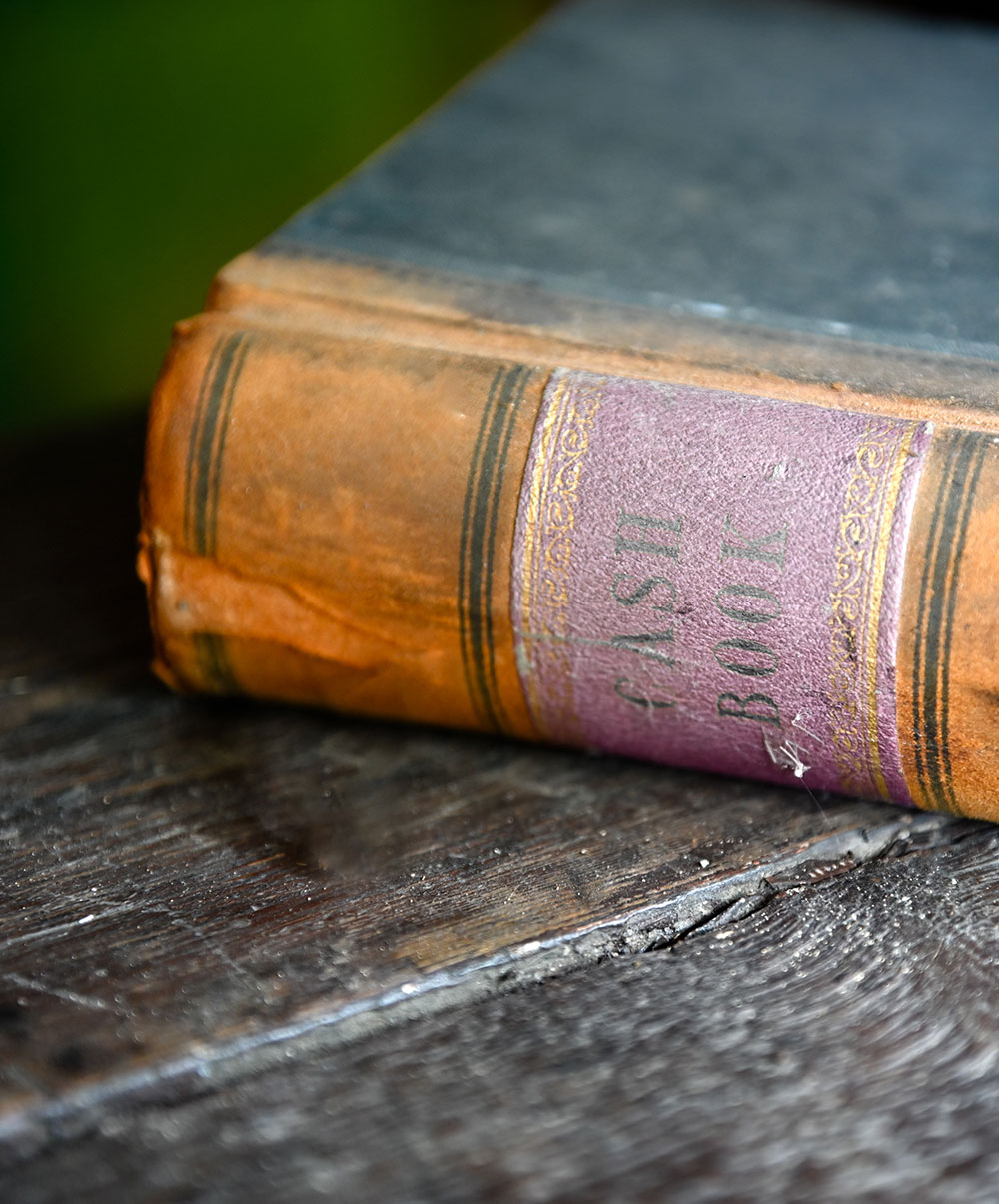

Rare Antiquarian Books

We can consider older volumes where scarcity, provenance or historical significance create strong market demand.

Private Collections

Curated libraries—whether literary, historical, scientific, travel-related, philosophical or genre-specific—are often eligible for sizeable lending amounts.

If you hold a rare or valuable book, or a collection with meaningful market value, we can usually provide a confidential secured loan.

Why Choose EAF for a Loan Against Rare Books?

How Our Loan Process Works

What Influences the Loan Value of Rare Books?

Edition & Printing

First editions, first impressions and copies with correct edition points usually command the highest valuations.

Condition

Dust jackets, binding integrity, absence of repairs, and paper quality all influence value significantly.

Provenance

Signed copies, association copies, books with notable prior ownership, or items with documented provenance enhance loan potential.

Rarity & Market Demand

Some titles have active collector bases or limited surviving examples, both of which increase value.

Completeness

Maps, plates, illustrations or inserts must be present where relevant.

Unlock the Value of Your Rare Books Today

A loan against rare books, a loan against a first edition, or a loan against a book collection is an efficient, confidential and secure way to access short-term capital without selling prized items. Whether you need funds for investment, business cash flow, a personal project or unexpected expenses, Edinburgh Asset Finance ensures a premium service, expert valuation and immediate access to funds.

If you own a rare or valuable book—or a collection you would like us to assess—contact us today for a discreet, no-obligation discussion.

Frequently Asked Questions

What makes a book eligible for a secured loan?

Eligibility is based on value, condition and market demand. First editions, rare antiquarian volumes, signed copies, fine bindings and important limited editions are typically suitable. If in doubt, we can review the book remotely and advise you instantly.

Do books need to be professionally graded or appraised?

No professional grading is required. We carry out our own valuation, although any existing certificates, receipts or appraisals you have can be helpful.

How is rarity determined?

Rarity is assessed through factors such as edition, age, surviving copies, historical significance, and current demand in the rare-book market. Our specialist will confirm this during the valuation process.

Are single books or full collections accepted?

Both are accepted. We can lend against a single high-value first edition or an entire collection if you wish to release a larger sum.

How is safe storage handled?

All books are stored in secure, high-grade facilities designed to protect sensitive materials. Temperature, humidity and light exposure are carefully controlled to preserve delicate bindings and paper.